Gig workers and freelancers comprise 36% of the U.S. workforce, according to Gallup and the gig economy is growing, even more so since the onset of the coronavirus pandemic. At GigSmart, we’ve seen a 460% increase in the number of hourly Gigs posted since March despite COVID-19 downfalls to the job market. Gig workers benefit from job flexibility and the opportunity to earn extra income and gain financial stability. But gig work also comes with gig economy taxes.

Tax season is upon us which means it is time for Gig workers to make sure they’re reporting their income and properly filing their Federal and State taxes. The tax filing process is much different than that of traditional workers, so it is important to prepare for tax season early. We are here to give you some tips to help you file your taxes like a pro. As a GigSmart worker on the Get Gigs app, you will not be provided a 1099-MISC form, but you still need to report income. A reminder, tax returns must be filed for the 2020 tax year by April 15, 2021.

Self-Reporting Your Income

As a gig economy worker, you will need to follow the steps provided by the IRS for Gig Economy Workers. Gig economy income is taxable and you must report income earned from the gig economy on a tax return. This includes part-time, temporary or side work.

How to Track Taxable Gig Income

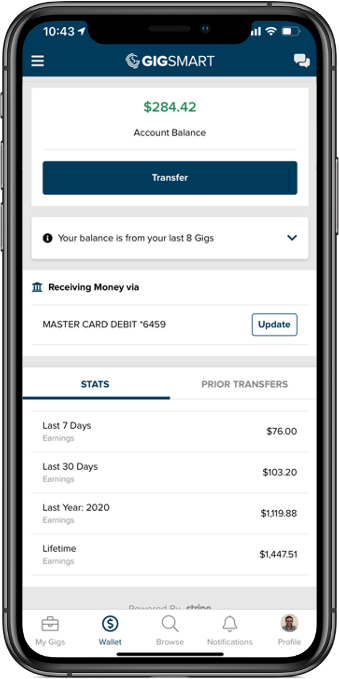

Collect and keep clean records of all the income you received and receipts during the year. GigSmart makes it easy to track your income and complete your tax return by viewing all previously completed Gigs from the app. To view your Gig earnings, follow the below instructions:

- Open the Get Gigs app on your mobile phone

- Once logged in, select the “Wallet” tab

- Find your 2020 earnings and add that amount on part 1, line 1 to the contractor’s 1040 form (the form most people fill out to report income).

If you have additional questions about filing your taxes as an independent contractor, visit the IRS’ Gig Economy Tax Center for further instructions and resources. If you need tax advice, you’ll need to consult an accountant or other appropriate professional, we’re not tax professionals.

Tax Software for Gig Workers

If you’re an independent contractor in the gig economy, taxes should be top of mind throughout the year. Start with keeping good records and when you’re ready to file your taxes, check out tax software, like TurboTax, to help you file your taxes with confidence.

TurboTax Premier

TurboTax Premier is a tax preparation software that can help you file your tax returns, especially when you need to report income as a self-employed individual or freelancer. It is slightly higher in cost than other platforms at $90, but it gives you the flexibility to easily do your taxes without the help of a tax professional. If you’d prefer some additional assistance, they also have a Live version for $170 (currently on sale for $140, not including state taxes) that will provide you with unlimited tax advice and answers from real CPAs and EAs.

Pros of TurboTax Premier

- User-friendly, interview-style flow

- Over 350 tax deductions searched

- 100% accurate calculations

- Guidance in case of an audit

TurboTax Self-Employed

TurboTax Self-Employed has all the great benefits TurboTax Premium does, but with additional benefits specific to self-employed individuals and freelancers. It is available for $120 (currently on sale for $90 not including state taxes), and also comes with a TurboTax Live option for $200 (currently on sale for $170 not including state taxes), giving you access to unlimited tax advice and answers from real CPAs and EAs. The most significant benefit of this program? The ability to track your expenses and categorize them in real-time throughout the year. Which makes filing your taxes at tax time a breeze.

Pros of TurboTax Self-Employed

- All the benefits included in TurboTax Premium

- On-the-go mileage tracking directly from your phone

- Snap a picture of receipts immediately – never lose track of expenses

TaxSlayer Self-Employed

If you’re comfortable filing taxes, and you can do without the step-by-step guidance TurboTax provides, TaxSlayer is a much more cost-effective solution. You’re able to file as a self-employed Worker, and while the basic version does not include professional tax help, the Self-Employed package gives you access to a tax professional to answer any questions you may have. It is available to file your Federal taxes for $47, and you can also submit your State taxes for an additional fee.

Pros of TaxSlayer Self-Employed

- Assistance from tax professionals

- Deduction finders for 1099 filings

- Access to tax tips and resources

- Tax payment reminders

- 100% accurate calculations

Most Common Gig Economy Tax Problems and Solutions

Gig workers experience many benefits – job flexibility, supplemental income, financial stability – but gig work also comes with tax challenges. Here are common taxes problems gig workers might face.

Quarterly tax payments

If you are new to gig work you might not be aware of aware tax payments. Since self-employment taxes are not withheld from (like they are from employees), employed have to pay those taxes by making estimated tax payments four times a year.

Quarterly tax payments are typically due on the following dates:

- First Quarter – April 15th

- Second Quarter – June 15th

- Third Quarter – September 15th

- Fourth Quarter – January 15th (of the following year)

Don’t forget to file

Gig economy workers might procrastinate on taxes or forget to file altogether. If you file your return more than 60 days late (including extensions), the minimum penalty is 100% of your unpaid tax or $435, whichever is smaller. Remember, it’s better to file on time even if you can’t pay right away.

For other helpful tips, check out these tax dos and don’ts for new gig workers.

As a GigSmart worker, it’s crucial to track and report the income you earn on the GigSmart app. By following the instructions above, you’ll be on the right path to properly filing. If you need any additional information, please contact your tax advisor as they will be the best resource to provide you with filing advice or tax advice specific to your situation. If you have any questions about the GigSmart platform, please contact our Support team.

NOTE: Everyone’s tax situation is different and while we’ve compiled these helpful tips, GigSmart does not, and is not intended to, provide legal, tax, or accounting advice. You should consult your tax advisor for filing advice or questions related to your specific situation.